JamboJon Newsletter

Boost Your Business with Rainy-Day Strategies

Welcome to this edition of The Compass. At JamboJon, everything can be an adventure, even during April showers. In this edition, we dive into the world of competitor analysis, showcasing how your businesses can weather storms by uncovering insights into what works well for others in your industry. In our tech tip, we’ll explore a simple strategy to mitigate unforeseen challenges on a project. You’ll get to meet our team member, Cassie Jones, and mark your calendars for an upcoming AI workshop taught in part by Sarah Johnson. Don’t miss out on our latest adventures in the pouring rain and one of our most recent case studies for a woman who had some website challenges pop up unexpectedly. Finally, just in time for tax season, we’ll answer your tax-related questions in our FAQ section. As always, share the love with family and friends - forward them the latest edition of The Compass for insights into the business and marketing world.

Featured Articles

Competitor Analysis: When It Rains, It Doesn’t Have to Pour

Every business must face stormy weather. When the proverbial skies darken, and raindrops smear against the window panes, you have a choice. You can curl up in a ball with comfy socks, hoping that the rain will go away on its own. Or you can pull out your galoshes and look for unique opportunities to dance in the rain. One rainy day tool that can help you make decisions about avoiding your business getting soaked, is the valuable resource of competitor…

Read MoreHow to Have Fun in the Rain

Sometimes, you just need to step away from the desk. Clear your head. When it’s raining outside, take advantage of the unexpected excursion. Be spontaneous! Go for a rainy hike. Breathe the deeply earthy smell all around you. Embrace your inner child and splash in puddles. Pack a waterproof picnic blanket, snacks, and cuddle under a covered porch listening to the raindrops. Capture the drizzly scene on your camera or smartphone. You don’t need to venture far to witness dramatic lighting,…

Read More

Meet Cassie Jones

Web Developer and Project Manager for JamboJon Websites

If you pass Cassie Jones on the street, you’ll know her because of the vibrant smile on her face. She shines as a project manager and web developer and is well-known at work for her meticulous attention to detail. She partnered with JamboJon nearly two years ago and continues to hone her industry experience in both front-end and back-end web development. Her clients praise her for her clear, engaging communication. She handles even the most difficult problems with grace and kindness.

When Cassie’s not grinding away at code, she’s biking alongside her husband and four wonderful children down the Las Vegas trail system. You might spot her dangling from the rock climbing anchors in Red Rock Canyon or snapping family portraits pictures against a waning sunset. Her family inspires her to get out of bed each day, photography sharpens her eye for detail, and rock climbing fuels her passion for challenge and focus. Be careful, though, she’s a shifty card shark who loves to trash talk!

News, Trends, & Promotions

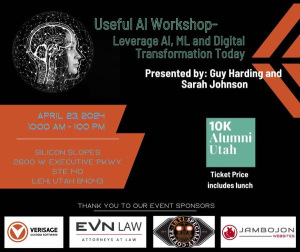

Learn from the Experts at an AI Marketing Workshop in Utah

Useful AI Workshop: Leverage AI, ML and Digital Transformation Today Tuesday, April 23, 2024 from 10am-1pm The buzz around AI and Machine Learning is getting too loud to ignore. But do you know how to implement AI in your business? Join 10K…

Read The ArticleTech Tips

How Do You Create a Gantt Chart?

You’ve planned your project with intricate detail. You’ve accounted for budget, materials, and helpers along the way. But sometimes, an unanticipated storm knocks your project off track. When your best-laid plans get smudged beyond recognition, even the simplest tools can help you…

Read The ArticleNew Launch

Good Life with Lindsay

Following Those Who Light the Way Health Challenges That Leave You in the Dark For thousands of years, humankind operated in the dark, aided only by candles or torches to light the way. When Benjamin Franklin discovered electricity, it changed the world…

Read The Article

FAQ

The short answer? It depends. According to Avalara.com, “If you sell online, you may have an obligation to collect and remit sales tax in one or more states. Whether you need to register for a sales tax permit in a state comes down to a concept known as nexus. Nexus is another word for connection. A state or local tax authority cannot impose a tax obligation on a business unless the business has a connection — or nexus — with the taxing jurisdiction.”

You are required to charge sales tax in your business’ home state. If your headquarters are in Dallas, you have to charge sales tax for customers who purchase products in your state of Texas. You may also need to register for online sales tax if you have a physical presence in a state, inventory or remote employees in a state, affiliate connections with a state, or other specific laws triggered by your specific business type that determine sales tax. Sometimes you are taxed based on a threshold of sales or direct/indirect referrals. Each state has a different threshold. For example, some states require you to pay sales tax when you hit $250,000 in annual sales, others $100,000 in sales, and a few just 100 orders. The better question is, “Do you have nexus?”

Be proactive. If you haven’t hit those thresholds, put it in your planning cycle to circle back to your accountant as you monitor growth and sales in new markets. If you think you have nexus, we recommend you consult with a tax advisor before deciding your next step. There are companies that can provide nexus analysis, sales tax registrations, and ways to help with compliance.

At JamboJon, we can build the connection of the tax tracking software to your e-commerce platform and will communicate with your accountant to determine the scope of your tax obligation. Setting up sales tax collection in each qualifying state requires the collaboration of your office, your accountant, and your web development team. We are happy to be a resource as your business continues to grow! For additional information about nexus, you can visit the following website: https://www.avalara.com/blog/en/north-america/2021/11/what-to-do-when-your-business-has-nexus.html

If you want to see a state-by-state guide on sales threshold, here is our go-to resource from Avalara. https://www.avalara.com/us/en/learn/guides/state-by-state-guide-economic-nexus-laws.html

Share The Love

If you know someone who will benefit from this newsletter, then please forward it to them.

Follow us on social media: